Foundational Finance for Strategic Decision Making

Contents

Coursera specializations offered by UM

Course I Time Value of Money

Simple Future Value (FV)

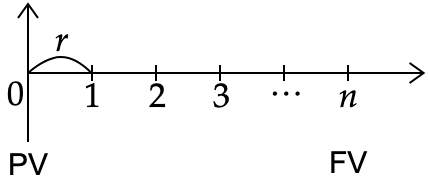

- PV = Present Value (unit: $)

- FV = Present Value (unit: $)

- n = # of Periods (#)

- r = Interest Rate (%, not $) > 0 (assumption)

Insight: A dollar today is worth more than a dollar tomorrow.

You cannot compare money across time.

Example: Power of Compounding!

Peter Minuit bought the Manhattan Island from Native Americans for $24 in 1626. Suppose that Native Americans could have earned 6% on their investments all these years. How much would they have today (year 2020)? $224,244,683,837.58

Some Important Formulae

- Future Value of a Single Cash Flow Invested for n Periods

$$F = P(1+r)^n$$

- Present Value of a Single Cash Flow Received n Periods from Now

$$P = F\frac{1}{(1+r)^n}$$

- Future Value of a Stream of Cash Flows as of n Periods from Now

$$F = C_1(1+r)^{n-1} + C_2(1+r)^{n-2} + \cdots + C_{n-1}(1+r) + C_n$$

- Present Value of a Stream of Cash Flows

$$P = \frac{C_1}{1+r} + \frac{C_2}{(1+r)^2} + \cdots + \frac{C_n}{(1+r)^n}$$